Decoding the Trifecta: Debt, Money Printing and Inflation

A simple guide to how these concepts interplay in our economy.

"Government debt is a way for the present generation to live at the expense of future generations."

- Ludwig von Mises

In recent times, the perpetual accumulation of federal debt has become a fact of life for governments around the world. However, when it comes to debt there are limits to how much a government can continuously accumulate before encountering severe economic issues. This is because large amounts of debt can significantly impact a country’s economic stability and currency over the long term.

In theory, a government can sustain debt growth indefinitely so long as its economy is growing faster than its accumulation of debt. Here we encounter the heart of the issue — in recent years federal debt has been growing far faster than GDP. This raises significant concerns about the long-term health of any economy. As the holder of the world's reserve currency (the US Dollar) and reserve assets (US Treasuries), the United States takes center stage in the global economic theater, making it the primary focus of this article.

The most common measure of assessing debt levels in any country is the Debt-to-GDP ratio, which relates a country's debt relative to their economic output. At the time of writing the US Debt-to-GDP ratio is over 120% meaning federal debt exceeds its annual economic output by more than 20%.

At the same time, the continued accumulation of US federal debt raises concerns about the potential for increased inflation over the long term. As the government borrows more money to finance its spending, it may be forced to print more money to pay off its creditors which can lead to inflationary pressures on the economy.

What is debt and why does it keep growing?

Federal debt is the amount of money the US government owes to its creditors, mainly other countries, firms, and individuals. The US federal debt has ballooned in recent decades from $6 trillion in the year 2000 to nearly $32 trillion at the time of writing, a staggering increase of 433%.

The reason for the massive expansion in federal debt can be largely attributed to one cause — deficit financing. This is when the government spends more than it collects in revenue and must borrow the difference to cover its expenses. Below we can see the growth of federal debt from 1980 to 2023 represented by the blue line and federal debt as a percentage of GDP represented by the red line.

Every year, the US government collects revenue from various sources such as taxes and incurs expenses to fund various government programs and services. When a governments revenue exceeds its spending it runs a budget surplus and when its spending exceeds its revenue it runs a budget deficit.

The last time the US government ran a budget surplus was in the year 2001, meaning government revenues exceeded spending in that year. Since then, the US government has continued to run budget deficits in which they spend more money than they collect in revenue. This is what has led to the massive accumulation of federal debt in recent decades.

To enable spending beyond their collected revenue, the US government relies on borrowing money through the issuance of US treasuries (bonds). This newly issued debt is commonly purchased by various financial entities. Most often, it is acquired by the country's central bank, who plays a significant role in acquiring the federal debt, both directly and indirectly.

With a click of a button, the central bank can create money out of thin air to purchase the government debt. By engaging in the purchase of government debt, central banks also maintain artificially low interest rates ensuring the debt burden remains manageable.

The process of government spending financed by their central bank is known as debt monetization. It is an inherently inflationary force since it inevitably leads to an increase in the country's supply of money. In the graph below, we can see the growth of the money supply in the United States between 1980 and 2023.

What is inflation and what causes it?

Today, inflation is most commonly defined as a general increase in the price of goods and services. However, this has not always been its definition. Historically, the word inflation directly meant an increase in the money supply, and the term “price inflation” was used to refer to the price increase in goods and services that followed.

In this sense, inflation isn’t caused by an increase in the money supply, inflation is the increase in the money supply. Using the word inflation to refer to a general increase in prices serves to conveniently obfuscate the cause and effect of this phenomena.

Regardless of which definition you choose, the result is the same. When more money is created in the economy but the amount of goods and services remains the same, this newly created money serves to bid up the prices of the existing goods and services. In this way, inflation serves to erode the purchasing power of money leading to higher prices and decreased living standards over time. Inflation is often referred to as a hidden tax since it reduces the real value of money while leaving the nominal amount unchanged.

The scenario described above is the most obvious effect of inflation. However, there are additional harmful effects that tend to go unnoticed. Because inflation distorts the real value of money, it leads to misdirected production, employment, and investment across the economy. This, in turn, results in malinvestment and the misallocation of capital. Inflation also undermines the perceived profitability of businesses and occupations diminishing the ability for individuals and firms to make sound economic decisions.

To make matters worse, inflation disproportionately impacts our most vulnerable populations, including poor and working-class individuals. These groups tend to have lower disposable income and fewer assets, making it difficult for them to absorb the rising cost of living that accompanies inflation.

Meanwhile, the richest demographics see their wealth increase. This disparity exists because their wealth is stored mainly in assets that appreciate under conditions of high inflation such as stocks and real estate. Consequently, inflation serves to widen the wealth gap further and intensifies inequity. Taken together, these second order effects of inflation threaten the long term stability and prosperity of any economy.

As federal debt continues its upward trajectory and deficit spending persists, countries will find themselves embarking on an increasingly precarious balancing act, attempting to strike a delicate position between effective economic management and the preservation of price stability. In a system based on perpetual credit expansion and debt growth, the risk of runaway inflation is something we should all be wary of.

Strategies to reduce the debt burden:

There are several strategies that could be employed by the US government to reduce their debt burden. The process of doing so is known as deleveraging and each strategy outlined below is not without significant trade-offs.

Raise Taxes

If the government finds itself in a situation where its spending exceeds its revenue, one strategy to make up for the difference is to raise taxes. Instead of printing money to fund the difference between their revenues and expenses, the government can raise taxes on its population, increasing its tax base and subsequently its total tax revenue.

Canada offers a stunning illustration of how this strategy can succeed. In 1990, Canada faced a significant debt crisis which the government addressed through a tax reform that increased the goods and services tax. This ultimately led to a significant reduction in Canada’s debt-to-GDP ratio.

However, this strategy may prove to be a difficult political task. Few will want to vote for someone who is going to take more money from their pockets. Taxes are also used as a policy tool to deter certain behaviour. If taxes were raised too much it may stifle economic activity and growth.

Reduce Spending

Another option to end the perpetual budget deficits is to reduce the total expenditures of the federal government. The US government currently spends well over $1 trillion a year on each of the following programs: Social Security, Medicaid, and Medicare. They also spend just under $1 trillion on both defence and the interest payments on their outstanding debt. Reducing spending on select programs or areas would help bring the budget into balance and ease the accumulation of debt.

This strategy is not without major challenges. Determining which areas are less necessary or where spending can be reduced without causing harm can be a complex process, especially amid high political polarization. Many of these programs are considered untouchable due to their popularity among Americans.

Ultimately, the strategy of raising taxes or reducing spending may prove to be unattainable political tasks. Even still, if fiscal restraint can be mustered and enough taxes were raised or spending reduced, it would be possible to run a budget surplus. If done properly, the US government could use this excess revenue to chip away at the federal debt over time.

Debt Default or Restructuring

Possibly the most devastating option, the US could default on its debt load. This has been theorized to have catastrophic effects on the global economy. The US Dollar is the world reserve currency, and US Treasuries are considered one of the “safest” investments available. As such, the US Dollar and US Treasuries are held across the world. Thus, a default on the federal debt would cause a global financial crisis. The US Dollar would likely collapse in value and the creditworthiness of the US would be severely damaged. This should be viewed as an extreme scenario, and the US government would likely take any other path to avoid a complete default.

Though a less severe option, restructuring the debt would still have harmful economic consequences. The process of restructuring the debt involves a renegotiation of terms between the debtor (the US government) and its creditors. Modifications of the payment schedule, interest rates or principal amounts owed could all be options to restructure the debt. This strategy would allow the US to avoid default while temporarily relieving its debt burden.

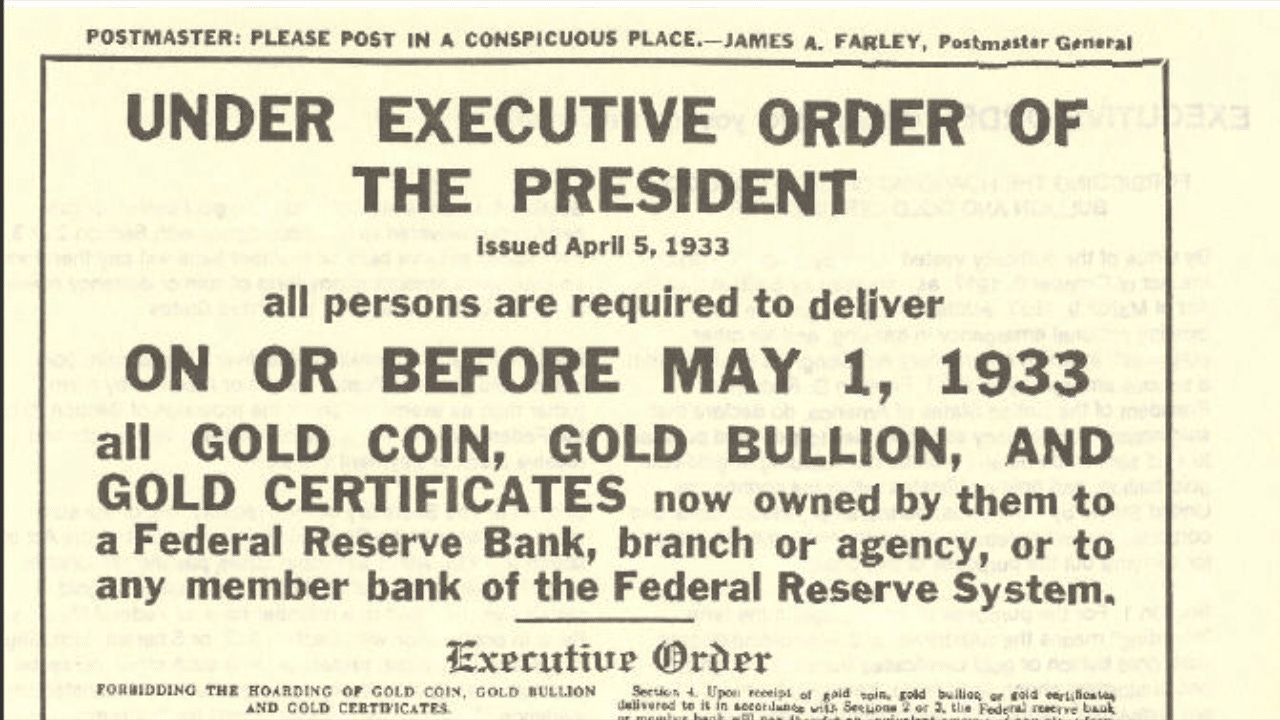

In 1933 President Franklin D. Roosevelt did just that. Through executive order 6102 Roosevelt required all gold coins and certificates to be surrendered to the US government in exchange for paper currency. This significantly devalued the US Dollar and helped the US pay off its debts. It should be noted that a restructuring today would look very different than it did in 1933.

Overall, restructuring the debt could still significantly damage the economy by inflating the currency and destroying confidence in the US’s ability to manage its finances. This would likely cause global economic turmoil as the US Dollar is the reserve currency and US Treasuries are held as a reserve asset in all corners of the world.

Inflate the Debt Away

Historically, one popular method to reduce the debt burden has been inflation. We may see the US government opt to inflate their way out of the current debt crisis. The process of inflating the debt away involves printing money thereby creating inflation and weakening the currency. By inflating the currency, the real value of US Dollars is less tomorrow than it is today. As a result, the US government could repay the same amount of debt with dollars that are worth less than the dollars initially borrowed.

For example, imagine the US government borrowed $100 at a fixed interest rate of 2% per year for 10 years. The government would owe $121 in principal and interest after 10 years. However, if inflation increased by an average of 3% per year over the same 10-year period, the $100 borrowed initially would be worth only about $74 in today's dollars. When it comes time to repay the debt, the government could repay the $121 in nominal dollars with $74 in real dollars.

In this sense, to successfully inflate the debt away, the currency must act as the release valve. While impossible to predict the magnitude of inflation, it is clear the US Dollar would suffer severe depreciation under this strategy. If the US Dollar were to experience hyperinflation it would have devastating impacts on the global economy.

Those who hold US Dollars would see their savings vanish as inflation rises uncontrollably. Living standards in the US would experience a sharp decline and confidence in the US Dollar as the world reserve currency would diminish, exacerbating the currency's depreciation. While the level of economic collapse brought about by the US Dollar hyperinflating is hard to predict, it remains a non-zero probability given the current state of affairs.

Final Thoughts

Ultimately, the US debt crisis is a complex issue with no easy solution. The strategies discussed of raising taxes, reducing spending, restructuring, defaulting, or inflating the debt away each has its advantages and disadvantages. The path the US government will take is hard to predict and will likely involve a variety of the strategies discussed above.

It is imperative to acknowledge that the debt problem is not an isolated issue but rather a systemic one. An economy built on perpetual debt growth is inherently inflationary and unsustainable in the long run. Therefore, any solution employed must address the root cause.

It must be recognized that the interplay between excessive government spending, artificially low interest rates, and debt monetization creates a highly inflationary environment. Moreover, the temptation to inflate the debt away may prove too tempting to resist. Together, these powerful economic forces could lead to high levels of inflation.

While impossible to predict the magnitude and duration of such inflationary pressures, it is clear they will pose significant economic challenges. Therefore, the US government must exercise fiscal restraint and make tough decisions if they’re going to ensure economic stability in the years to come.