Bitcoin's Role in Deflating the Everything Bubble

An analysis of monetary premiums and how Bitcoin stands to benefit from decades of artificial asset inflation.

In 1971, a pivotal event coined the "Nixon Shock" unfolded, sending waves through the global economy. Under the presidency of Richard Nixon, the United States officially departed the Gold Standard. Prior to this monumental decision, the US Dollar had been backed by and redeemable for gold since Congress passed the Gold Standard Act in 1834.

This historic shift propelled the world economy into the era of fiat currency, wherein government-issued money became detached from any tangible backing. With the severance of the US Dollar's link to gold, the US government gained the liberty to expand the money supply according to its own discretion. This shift laid the groundwork for significant economic developments that have continued to shape our present-day global economy.

"The gold standard was the world's monetary system for centuries, and it was the basis for economic stability, growth, and individual freedom. The abandonment of the gold standard and the move towards fiat currencies has allowed governments to manipulate money, engage in excessive spending, and erode the value of people's savings."

-Murray N. Rothbard

Consequently, the ensuing five decades have witnessed an exponential surge in the supply of money, far surpassing what would have been feasible had the dollar maintained its backing in gold. M2, a common measure of the money supply in the US, has increased by more than 3,150% since the Nixon Shock.

Gold itself has performed admirably during this time, surging from a mere $35 per ounce in 1971 to nearly $2000 per ounce in 2023. This exceptional growth translates to a staggering return of over 5,150%, vividly illustrating the substantial devaluation of the US Dollar relative to gold since 1971.

In this article, we delve into the rise of monetary premiums born from decades of easy money. We examine how these policy choices have led to inflated asset valuations and explore the potential role of Bitcoin as a superior store of value in an era marked by monetary manipulation. Through an examination of the historical shift from the gold standard, an analysis of the factors driving inflated asset valuations, and a consideration of the merits of Bitcoin, we aim to shed light on the potential role of Bitcoin in deflating the everything bubble.

Inflated Assets

The meteoric rise in asset valuations extends well beyond gold. Due to the abundance of money, the post-1971 era has witnessed an unprecedented surge in asset values across the globe. Housing prices in particular have risen significantly. For instance, consider the average home price in the US, which stood at a mere $24,300 in 1971. Fast forward to 2022, and the same home now sells for $479,500, reflecting an astounding increase of over 1,850%.

Stock prices have experienced a similar extraordinary surge. This is exemplified by the performance of the S&P 500 index—a gauge of the 500 largest public companies in the US. Analysis reveals average annual returns exceeding 10.5% since 1971. To put this into perspective, a $500 investment in the S&P 500 back in 1971 would now be valued at over $100,000, yielding an astonishing return of over 20,000%.

As a result of this surge in asset valuations, individuals now expect stocks and real estate to inevitably rise in value. This belief has become deeply ingrained, leading individuals to develop a sense of complacency or even entitlement when it comes to the continuous upward trajectory of these assets. Consequently, individuals have established the perception that investing in stocks or acquiring real estate guarantees wealth accumulation.

This mindset influences the behaviour of investors and homebuyers, shaping their decisions and contributing to the sustained demand that perpetuates the upward trend in asset valuations. However, it is crucial to examine the underlying factors driving this phenomenon and critically evaluate whether this perpetual upward trajectory is sustainable or if it is indicative of an artificial inflationary environment.

Why Assets are Inflated

While analyzing the surge in asset valuations, it may seem evident to conclude that the increase in property value or stock prices has resulted from heightened demand or exceptional growth in the underlying asset. While these factors do contribute to the inflated valuations to some extent, more significant forces have played outsized roles in driving asset valuations well beyond their fundamental value.

In essence, it is has been the manipulation of money by central banks that has disconnected asset prices from reality. This occurs through two mechanisms simultaneously:

They print tremendous amounts of money—which leads to inflation that drives up the price of all assets, goods and services.

That very same inflation destroys one of the primary functions of money: a store of value.

When money fails to retain its value, investors turn to alternative assets like gold, stocks, real estate, and bonds as a means of preserving their wealth. This has resulted in further upward pressure on the prices of assets as people flee depreciating money to better preserve their wealth, resulting in an even wider disparity between an assets fundamentals and its valuation on the market.

The disconnect between an assets fundamental value and its market valuation is known as a monetary premium and stems from the artificial inflation of the asset due to monetary manipulation. Together, the forces of inflation and the inherent inability of fiat currencies to serve as reliable stores of value have propelled asset prices to astronomical levels that far exceed any justifiable fundamental valuations. In the current economic environment, there are scarce few assets that do not carry a monetary premium.

The existence of monetary premiums further exacerbates the challenges faced by individuals who cannot afford homes or assets, as the valuations of these assets escalate at a much faster rate than their income. Today, a growing number of individuals from my generation hold doubts about their ability to achieve the once-attainable goal of homeownership, a stark contrast to the more accessible opportunities experienced by previous generations. In this way, the presence of monetary premiums also serves to deepen the wealth gap as the rising valuation of assets outpaces income growth of individuals who do not own assets, amplifying the divide between those who can afford them and those who cannot.

However, there is a silver lining. One asset that has not succumbed to such artificial inflation is Bitcoin. As Bitcoin continues to monetize and demonstrates its superiority as a store of value asset, it may be poised to absorb the monetary premiums that have built up in assets over decades of artificially cheap money. This in turn could help make life more affordable for many and highlights the role Bitcoin could play in deflating the everything bubble.

Bitcoin excels in fulfilling all three functions of money:

Bitcoin is a Medium of Exchange: Bitcoin facilitates seamless transactions for the purchase and sale of goods and services. Its decentralized nature and global accessibility enable individuals to engage in economic transactions securely and swiftly across borders.

Bitcoin is a Unit of Account: Bitcoin allows for the measurement and comparison of the value of various goods and services. Its divisible nature, with each Bitcoin being divisible into smaller units called satoshis, provides flexibility in pricing and precise valuation.

Bitcoin is a Store of Value: With a predetermined supply limited to 21 million coins, Bitcoin possesses an inherent scarcity that sets it apart. The inability for anyone to create additional bitcoins underpins its status as an absolutely scarce asset. This quality positions Bitcoin as an increasingly popular choice for long-term wealth preservation.

Considering the above, it is not unreasonable to expect portions of wealth stored in assets that carry a heavy monetary premium to flow into Bitcoin over time. Specifically, individuals heavily rely on assets like gold, stocks, and real estate to preserve their wealth outside of fiat cash. Consequently, substantial monetary premiums have accumulated within these assets, which could be susceptible to disruption by an asset offering superior store of value characteristics, such as Bitcoin. This scenario is well supported when considering the following two factors:

Bitcoin is the world’s superior store of value asset.

Bitcoin’s market cap represents a small fraction of global asset value.

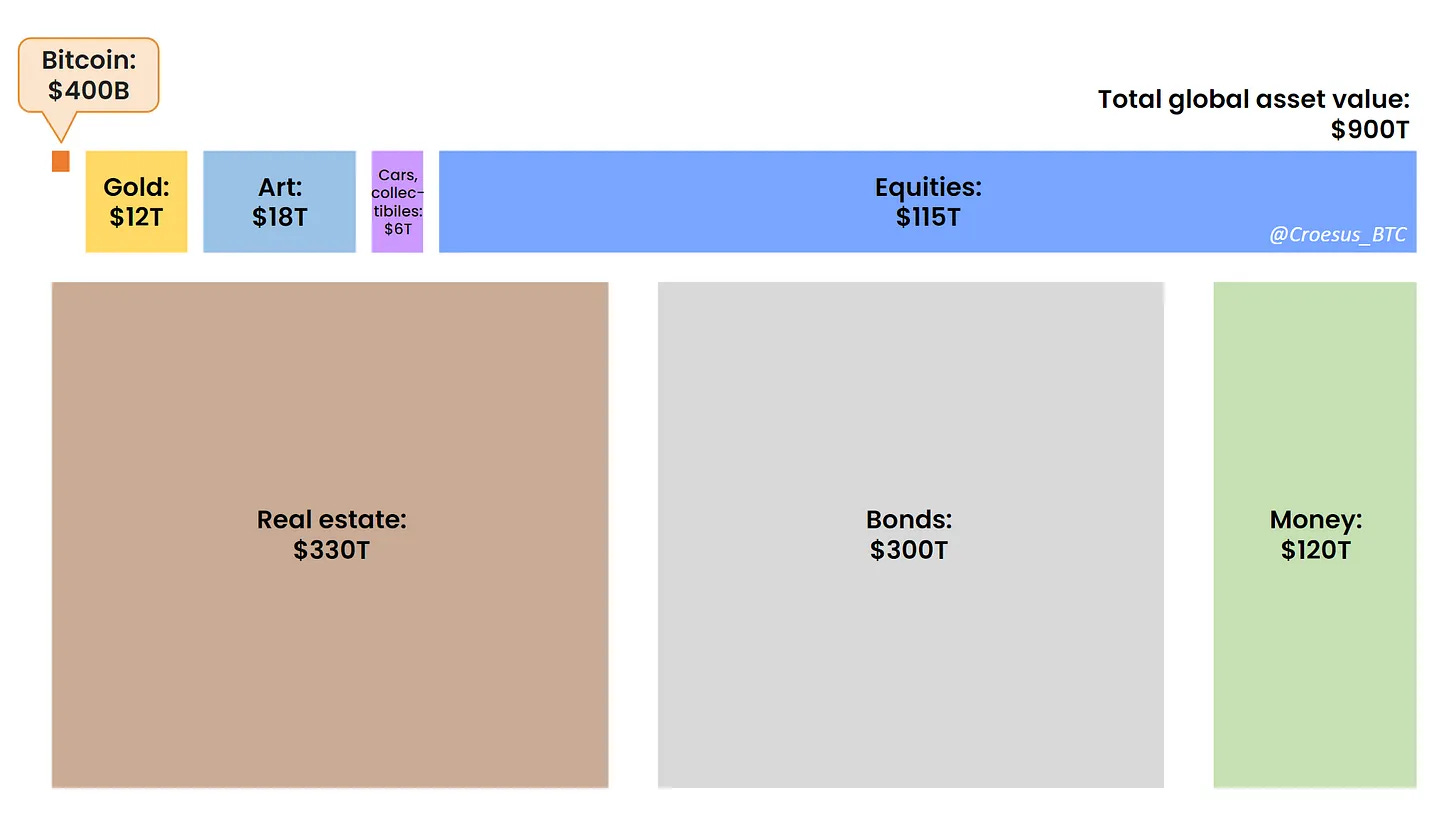

While calculating the total global asset value can be a difficult task, there are various estimates out there. A study from McKinsey estimates there is around $1,020 trillion on the global balance sheet, in other words roughly $1 quadrillion in global asset value. Similarly, Jesse Myers, author of the “Once-in-a-Species" newsletter estimates there is roughly $900 trillion in global asset value. At a market cap of roughly $500 billion, Bitcoin constitutes a mere 0.05% of total global asset value.

As long as Bitcoin continues to function as intended, its exceptional ability to serve as a store of value will become increasingly evident. While the precise extent to which Bitcoin can absorb value from alternative assets remains uncertain, its superior economics ensure that its current share of global asset value, currently at 0.05%, will undoubtedly expand.

If we assumed a scenario in which only 1% of all global asset value (roughly $10 trillion) flowed into Bitcoin, this would imply a price of ~$500,000 per Bitcoin. This should be considered an extremely conservative scenario given Bitcoin’s superiority not only as a store of value but also its ability to function as an entire monetary system.

On the other hand, if we make a more aggressive estimate and assume 25% of all global asset value (roughly $250 trillion) flowed into Bitcoin, this would imply a price upwards of $11 million per Bitcoin. This tremendous valuation highlights how scarce Bitcoin really is.

In contrast to other assets, Bitcoin also represents an entire monetary ecosystem. It encompasses not only a highly efficient payments network but also superior store of value characteristics. Considering this, the total addressable market for Bitcoin could encompass the entire world, representing a staggering value of $1 quadrillion. Whether or not this plays out in reality remains to be seen, but these observations underscore Bitcoin's tremendous prospects in a world grappling with depreciating currencies and excessively inflated assets

Having examined the factors that led to excessive monetary premiums in assets, it becomes evident that Bitcoin is poised to play a significant role in deflating the everything bubble that has built up over decades of loose monetary policy. With its capacity to absorb the accumulated monetary premiums resulting from years of monetary debasement, Bitcoin stands ready to offer an alternative monetary system that empowers its users rather than impoverish them.

Excellent article Zac! I like that you presented both sides of the the inflation "coin", whereby people fleeing a currency into scarce assets has the simultaneous effect of eroding the Store of Value function of that same currency, creating something of a positive feedback loop. Cheers! -Matt (Peace River, AB)

Great work.