Bitcoin is Trending Toward Perfect Competition

Despite the notion that Bitcoin mining is centralized, market dynamics in the Bitcoin industry are nearing ideal conditions.

Critics of Bitcoin and the Proof-of-Work consensus mechanism frequently express concerns about the centralization of Bitcoin mining. However, a closer examination reveals a more nuanced reality—one in which the Bitcoin mining landscape is continually evolving towards greater decentralization and a competitive equilibrium.

In economics, the term 'perfect competition' describes the ideal market conditions within a particular industry. While perfect competition underscores an idealized market scenario, it remains largely theoretical and seldom attainable in practice, with only a handful of industries coming close to meeting the necessary conditions. In this article, we will debunk the notion that Bitcoin mining is centralized by highlighting how the industry increasingly embodies the characteristics of a perfectly competitive market.

The Characteristics of Perfect Competition:

Large Number of Buyers and Sellers

Firms Sell a Homogenous Product

Freedom of Entry and Exit and Perfect Mobility of Factors of Production

Firms are Price Takers

Perfect Market Information

Normal Profits

Large Number of Buyers and Sellers

Those arguing Bitcoin mining is centralized often refer to the large scale mining operations from Bitcoin mining companies. However, a closer analysis of publicly listed Bitcoin miners reveals they’re growing in numbers and even the largest miners operate only a small percentage of the total Bitcoin hashrate, which is hovering around 450 Exahash a Second (EH/s).

For instance, Core Scientific, the largest publicly traded Bitcoin miner by hashrate is operating at 22 EH/s, representing only 4.89% of the total global hashrate. It is also worth noting they filed for Chapter 11 bankruptcy in December of last year. The effect this will have on the companies continued operation is uncertain, but the bankruptcy filing of a major player underscores the industry's ruthless competitiveness, where no entity, regardless of size, is immune to market forces.

Below I’ve compiled a list of the 15 largest public Bitcoin miners by operational hashrate and their share of the global hashrate in percentage terms. Notice how other than Core Scientific, few Bitcoin miner boast more than 2% of the global hashrate, highlighting the decentralized nature of Bitcoin mining.

To take this a step further, consider the Herfindahl-Hirshman Index (HHI), a widely recognized measure of market concentration in economics. HHI scores range from 0-10,000 and are calculated as follows, where ‘s’ is the market share in percentage terms of firm ‘n’.

HHI < 100 indicates a highly competitive industry.

HHI < 1500 indicates a non-concentrated industry.

1500 < HHI < 2500 indicates a moderately concentrated industry.

HHI > 2500 indicates a highly concentrated industry.

HHI = 10,000 indicates a perfect monopoly.

In the context of the HHI, a lower score suggests a more decentralized and competitive market. Computing this equation for the top 15 public Bitcoin miners reveals a HHI score of 58.18, indicating Bitcoin mining is a highly competitive industry. This aligns with the idea that the Bitcoin market is characterized by a diverse set of participants without any single entity or a small group dominating the industry. This quantitative analysis using the HHI supports the argument that Bitcoin mining is decentralized and aligns with the principles of perfect competition.

Bitcoin mining also stretches well beyond publicly traded companies and large scale mining operations. There are countless individual miners globally thanks to the low barriers of entry of Bitcoin mining which is generally characterized by accessible technology and low capital requirements. This low barrier to entry, allows anyone to mine Bitcoin granted they have access to profitable electricity, further underpinning the global and decentralized nature of Bitcoin mining.

Furthermore, mining pools have gained popularity as a method for individuals to mine Bitcoin more profitably. You can think of these as a combined pool of individuals hashrate coming from their own Bitcoin miners. Individuals pooling their hashrate allows for higher chances of producing a block and being awarded Bitcoin, which is split proportionately between the participants of the mining pool. This makes Bitcoin mining even more accesible for individuals while maintaining sovereignty over the mining equipment itself.

Additionally, many countries have even begun their own Bitcoin mining operations, capitalizing on this emerging technology to reinforce and diversify their economy. El Salvador is mining Bitcoin via the geothermal energy provided from its many volcanoes and Oman just announced a $1.1 billion dollar investment in Bitcoin mining infrastructure.

Considering the global nature of Bitcoin mining and its low barriers to entry, it becomes clear there is a very large number of sellers (i.e. Bitcoin miners) in the Bitcoin market. Despite the presence of large-scale mining operations from publicly traded companies, a closer examination reveals a diverse ecosystem of miners made up of individuals, firms, pools, and even nation states, challenging the notion that Bitcoin mining is centralized.

Lastly, there are a large number of buyers in the Bitcoin market as a result of its global accessibility, diverse investor base, the proliferation of exchanges, and the versatility of payment methods. When considering all of the above factors it becomes clear the Bitcoin market is made up of a diversified number of buyers and sellers. While there is no official threshold at which a market achieves the first tenet of perfect competition, Bitcoin mining has shown it is absent of any dominant entities, allowing it to operate in a manner consistent with perfect competition.

Homogenous Product

In the realm of Bitcoin mining, all mining firms unequivocally sell a homogenous product—Bitcoin itself. The very nature of Bitcoin ensures its fungibility and uniformity. Whether mined by an individual with a single mining rig or a large-scale mining operation, the Bitcoin generated is indistinguishable. This homogeneity stems from the foundational principles of blockchain, where each Bitcoin is a cryptographic token secured by the same underlying protocol. It's akin to a digital gold bar, and once created, it becomes part of the global Bitcoin network, ready for trade and use.

The significance of this homogeneity extends to the broader Bitcoin market, where the fungibility of Bitcoin is paramount. Regardless of where you obtained your Bitcoin, the value and utility of each unit remains consistent with all other units on the network. This characteristic aligns closely with the idealized conditions of perfect competition, as buyers face an array of interchangeable options from a multitude of sellers. Bitcoin has solidified itself as a homogeneous product in the market, allowing it to achieve the second condition of perfect competition.

Freedom of Entry and Exit

Freedom of entry and exit, along with perfect mobility of factors of production, are key characteristics of perfect competition. Bitcoin mining stands as an example of how these principles are not only achieved but thrive in a decentralized ecosystem.

When mining Bitcoin, the barriers to entry are exceptionally low, allowing virtually anyone with access to the necessary resources to participate. This accessibility is made possible by the technology's open-source nature, which means that the mining software and protocols are freely available for anyone to use. Moreover, the hardware used in mining is commercially available, with various options suited for different budgets and expertise levels. This ease of access ensures that miners can swiftly join the network and start contributing their computational power to secure and mine Bitcoin.

Perfect mobility of factors of production in Bitcoin mining is exemplified by the global and borderless nature of the industry. Miners can set up operations in various locations based on factors like electricity costs and climatic conditions, resulting in a highly competitive and flexible landscape. This freedom of mobility enables miners to optimize their operations continually, adapting to changing market conditions and regulations. It underlines the core tenets of perfect competition, as all miners have equal opportunities to participate, adjust their strategies, and exit the market as circumstances dictate.

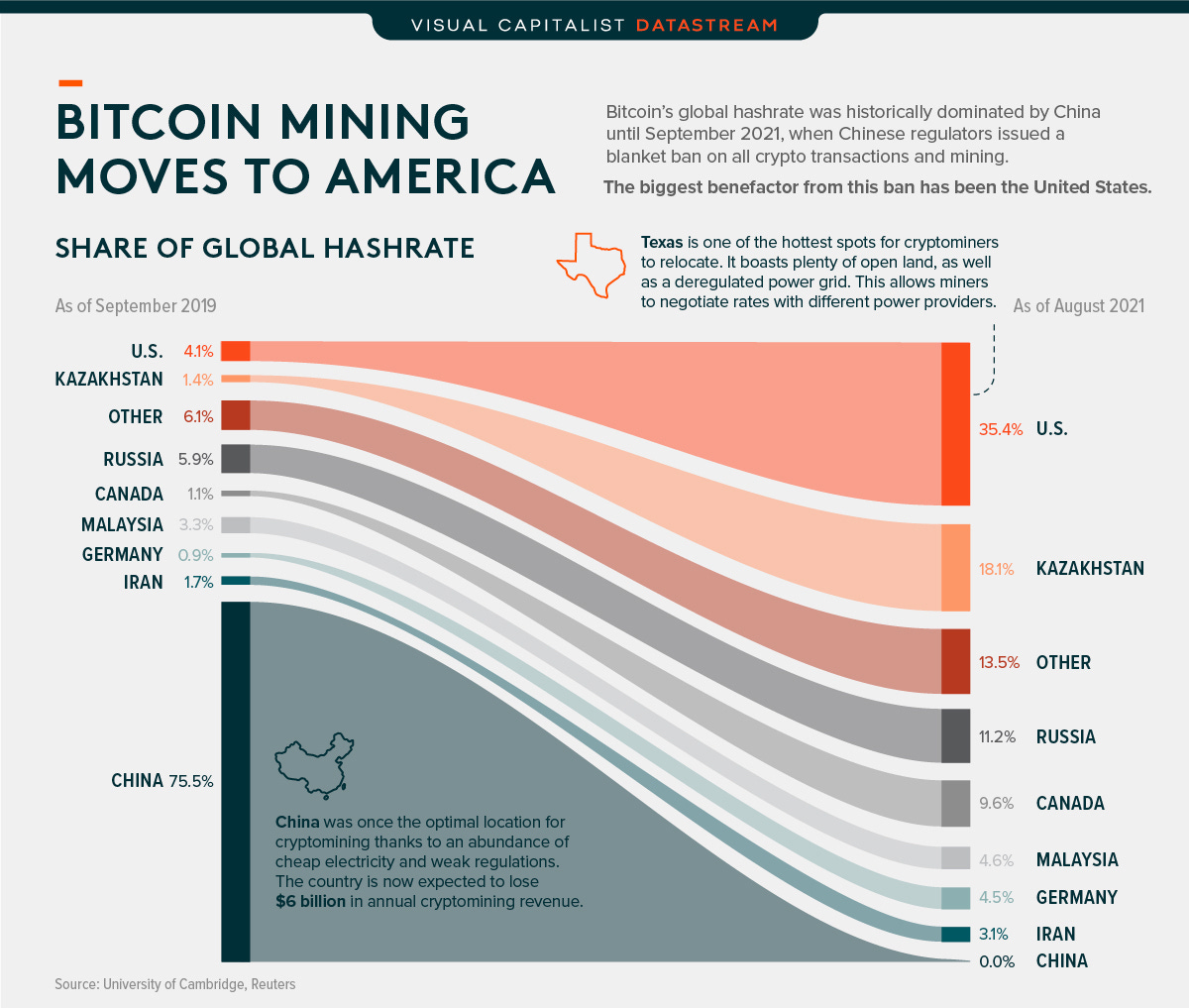

A stunning example of this mobility can be seen following the 2021 ban on Bitcoin mining in China. This ban resulted in a mass exodus of miners out of China and into other countries—decentralizing the network and further highlighting the adaptability and mobility of the mining industry.

As with any industry, Bitcoin mining may be imperfect in the sense that there are some degree of barriers to entry and exit. However, its relatively low barriers as well as its very mobile factors of production allow Bitcoin mining to increasingly embody these core principles of perfect competition.

Firms are Price Takers

Unlike traditional industries where larger entities might exert significant influence over market prices, Bitcoin miners have no such power. They must accept the market-determined price for their mined bitcoins, reflecting the transparent and decentralized nature of the market.

The price of Bitcoin is determined by the collective forces of supply and demand, shaped by a vast and diverse array of market participants. This includes individual retail investors, institutional traders, and a multitude of exchanges worldwide. Bitcoin miners operate under these market conditions as mere contributors to the network's security and transaction validation. They have no authority to influence or manipulate the price of Bitcoin in any significant way.

In essence, Bitcoin miners are price takers who adapt to the economic realities of the market price driven by supply and demand, thus demonstrating another core attribute of perfect competition.

Perfect Market Information

In contrast to many traditional markets where information can be closely guarded or selectively disclosed, the Bitcoin network operates openly, providing real-time and comprehensive data accessible to all participants.

Bitcoin miners have access to a wealth of information about the network's current state, including the hash rate, mining difficulty, block rewards, and transaction data and fees. This data is publicly available and regularly updated, enabling miners to make informed and rational decisions about their operations. This level of transparency instills trust in the network and fosters a competitive environment where participants can actively respond to market changes.

Additionally, buyers in the Bitcoin market also benefit from this high degree of market information transparency. They can access real-time data on the Bitcoin price, trading volumes, historical price trends, and more. This allows them to make well-informed purchasing decisions, ensuring that they are well aware of the prevailing market conditions. For example, Timechain Calendar beautifully displays live information of the Bitcoin network:

To summarize, the Bitcoin industry benefits from a high degree of market information transparency, enabling all market participants to make rational decisions and adjust their strategies in response to changing conditions. This open and verifiable information mirrors the principles of perfect competition, where participants have access to the data they need to compete effectively in the market.

Normal Profits

The concept of normal profits in perfect competition reflects a state where firms earn a return that covers their opportunity cost of capital. In the Bitcoin mining industry, the expectation of normal profits is a rational approach, and the historical trajectory of the industry suggests that it will indeed trend toward this equilibrium.

Bitcoin mining has evolved over time, marked by initial phases of high profitability, driven by the surging price of Bitcoin and the reduced competition. However, as more miners have entered the network and technological advancements have increased mining efficiency, the profit margins have compressed. In the quest for normal profits, miners must continuously optimize their operations, seeking the most cost-effective solutions and efficient energy sources to maintain viability in the highly competitive market.

The Bitcoin network's self-regulating mechanism, which adjusts the mining difficulty based on the overall computational power in the system, further contributes to the industry's trend toward normal profits. As more miners join or exit the network, the difficulty level adapts, ensuring that the average miner's return aligns with their costs of production, effectively preventing excessive profits.

Over the long term, Bitcoin mining operations tend to operate at or near their marginal cost, balancing revenue with expenses. This equilibrium helps stabilize the industry, ensuring that miners who remain in the market do so with a focus on achieving normal profits. Those who cannot maintain this balance exit the market, increasing profitability for other miners, which eventually entices new participants into the market and a return to normal profits.

Bitcoin mining exemplifies how a competitive market, underpinned by perfect competition principles, gravitates toward the concept of normal profits over time. The dynamic and self-adjusting nature of the Bitcoin network, along with miners' rational decision-making, fosters an equilibrium-seeking industry where profitability aligns with their costs of production.

Whether Bitcoin achieves perfectly normal profits over the long term is yet to be determined, but industry dynamics and current trends strongly suggest that this may indeed be the case. This trend towards normal profits further underpins the Bitcoin industries long term convergence with perfect competition.

Final Thoughts

Bitcoin’s long term trend toward perfect competition is reflected in its decentralized structure, the homogeneity of its product, and inherent factors such as the freedom of entry and exit, price-taking behaviour, and extensive market information.

As we illustrated, Bitcoin mining is decentralized, with a multitude of participants contributing to the network's security and integrity. These miners operate at various scales, from individuals to public companies and nation states, and together, they maintain a competitive and inclusive ecosystem. This aligns with the idealized conditions of perfect competition, where no single entity dominates the market.

Furthermore, Bitcoin mining meets the criterion of a homogenous product. Every Bitcoin mined is indistinguishable, regardless of its source. This fungibility underscores the uniformity of the product and reinforces the case for perfect competition.

The industry's low barriers to entry and high mobility of factors of production demonstrate its adherence to other key tenets of perfect competition. Miners can freely enter and exit the market, adjusting their strategies to respond to changing conditions. They are price takers, adapting to the market-determined price of Bitcoin, and the trend toward normal profits ensures a balanced and competitive industry.

While the concept of perfect competition serves as an idealized benchmark, Bitcoin mining has indeed made significant strides toward encompassing it core tenets. The decentralized, competitive, and dynamic nature of the industry reflect its increasing alignment with the principles of perfect competition. With the continued growth and evolution of the Bitcoin network, it is probable that the industry will progress further on its journey toward perfect competition, setting a compelling example for the world at large.

Newsletter Recommendation: N+1 Action

Subscribe Today: https://www.nplus1insights.com/

I think you forget to add that the so called "equilibrium" and "normal profits" will never be realized unless we operate in an evenly rotating economy.