2023 Macro Outlook: 7 Signs of a Looming Recession

Examining key economic indicators to asses the current state of the economy.

As we enter the latter half of 2023, debates surrounding the possibility of a recession are only increasing. Those arguing that we will see a recession cite factors such as tightening credit conditions and recent bank failures as clear warning signs of a slowing economy. On the other hand, some believe that the global economy is resilient enough to weather any storm, pointing to recent positive indicators such as the low unemployment rate and strong performance in equity markets.

Amidst these contrasting views, it is crucial to examine the signs that suggest a recession may be on the horizon. By closely analyzing key economic indicators, we can gain valuable insights into the economy's overall health and make informed predictions about its future trajectory. In this article, we will explore some of the compelling indicators that warrant our attention and examine the potential risks that we may face. From yield curve inversions to tightening credit conditions these indicators serve as early warnings that could foretell an impending economic downturn.

How we got here

Setting the stage for the current economic landscape, the past decade has witnessed significant events and policies shaping our present-day circumstances. The global recession known as the Great Financial Crisis, which unfolded in the fall of 2008, marked a pivotal moment in recent history. In its aftermath, governments and central banks worldwide implemented unprecedented measures to stimulate economic growth and stabilize financial markets.

Quantitative easing became an essential monetary policy tool, with central banks injecting vast sums of money into their economies to stimulate growth. Coupled with near-zero interest rates, this approach aimed to encourage lending and thereby boost economic activity. However, these policies also had unintended consequences. Asset prices inflated well beyond their fundamental values, and the financial system became addicted to liquidity.

The stage was then unexpectedly altered by the onset of a global pandemic when COVID-19 swept across the world. The United States, among other nations, responded with massive fiscal spending, resorting to unprecedented levels of money creation. To keep the economy afloat during the pandemic, nearly 40% of all dollars in existence were printed. The inflation that followed such massive monetary expansion has proven to be more persistent than anticipated, posing yet another set of challenges.

These trends mirror the expansionary phase of the business cycle, characterized by periods of growth and prosperity. We must recognize that such an expansion, particularly one fuelled by prolonged loose monetary policies, is naturally followed by a bust. History has shown that economic downturns often follow periods of artificial stimulation, as witnessed during the Great Depression in the aftermath of the roaring 1920s in the United States.

As we navigate the economic landscape today, it is increasingly important to evaluate the potential consequences of this prolonged expansion and the unprecedented measures taken to sustain it. Examining key indicators that have historically preceded economic downturns is essential for understanding the current environment and preparing for potential challenges that lie ahead.

1. Yield Curve Inversion

Interest rates play a pivotal role in the economy, serving as essential economic indicators. Some of the most important interest rates to monitor are the yields offered on government-issued bonds. Governments issue bonds with various maturities known as US Treasury Bills (another way of saying US national debt). These bonds are offered to the public and they’re allowed to purchase them by paying the principal amount and in return they earn a yield on the bond until it reaches maturity.

Essentially, investors who buy bonds act as lenders to the government, and in return, the government pays them interest (yield) throughout the bond’s duration. In this way, the yield on a bond can be thought of as the cost of borrowing money.

The yield on bonds fluctuates daily based on demand as well as in response to changing economic conditions. In normal times, the longer the duration of a bond, the higher the yield. This is because investors demand higher compensation for tying up their money for an extended period due to the increased risk associated with uncertain economic conditions and inflation.

In times of heightened economic uncertainty, it is possible to see the yield on short-term bonds surpass the yield provided on long-term bonds. This is exactly what happened in June of 2022 when the yield provided on a US 2-Year treasury bond surpassed that of the yield provided on a US 10-Year treasury bond. This is known as a yield curve inversion and reflects overall uncertainty in near-term economic conditions:

Investors displayed a preference for holding long-term bonds over short-term bonds, driving this inversion due to concerns about the short-term economic outlook. This shift in sentiment led to a surge in demand for long-term bonds, causing their prices to rise and their yields to decrease. Conversely, demand for shorter-term bonds declined, exerting downward pressure on their prices and driving their yields higher. Consequently, the two yield curves inverted, creating the observed phenomenon as depicted above.

In summary, yield curve inversions have become a reliable indicator of recessions as they serve as gauges of uncertainty surrounding the near-term economic outlook. In other words, it signals to investors that there may be turbulence ahead. In fact, since 1969, a yield curve inversion has preceded every US recession. Fast forward to 2023, and the yield curves of the 10-Year and 2-Year treasury bonds have been deeply inverted for over a year now. This begs the question—where is the recession?

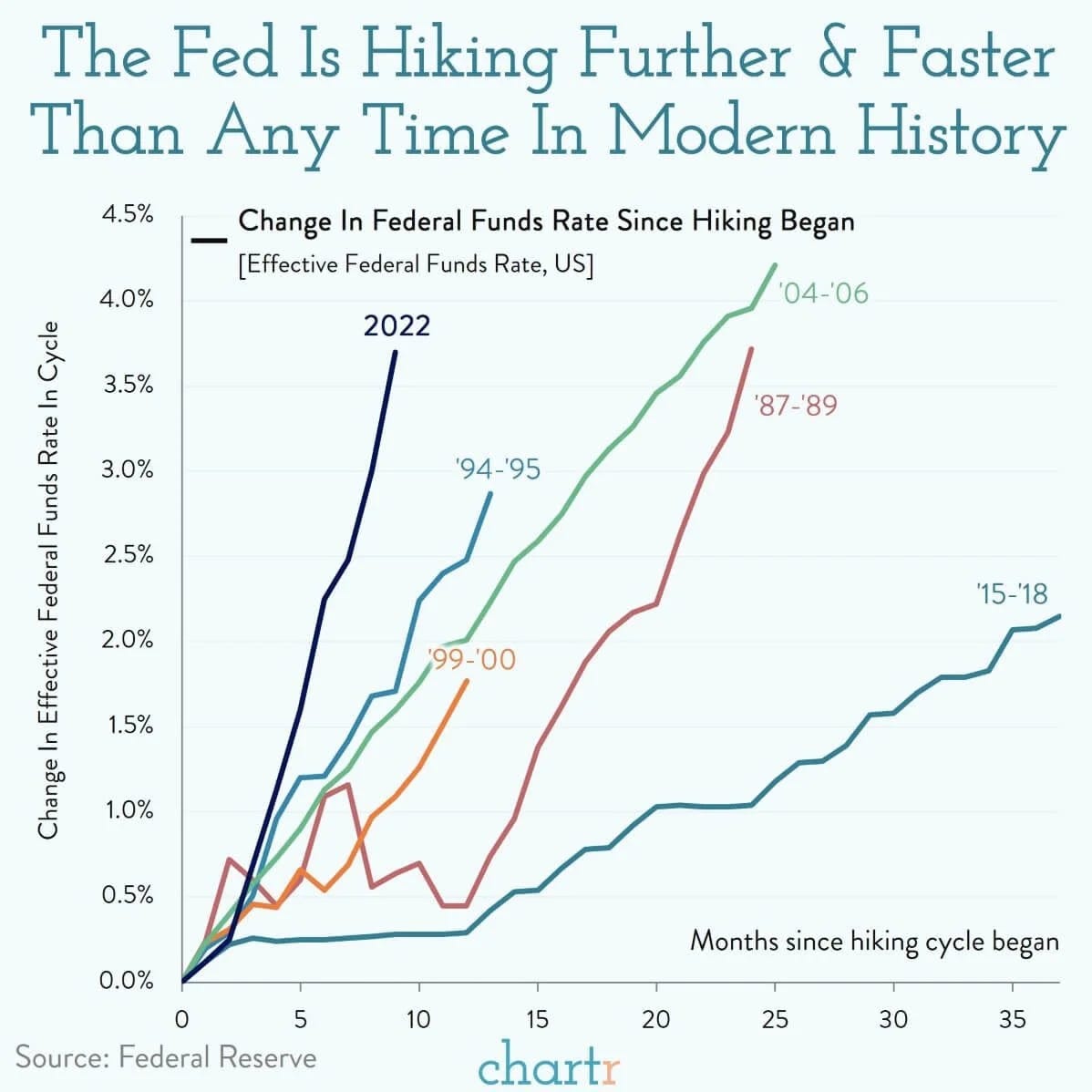

2. One of the Fastest Interest Rate Hikes in U.S. History

As we delve deeper into the potential signs of an impending recession, a crucial factor that cannot be ignored is the recent actions of the Federal Reserve. After a decade of loose monetary policy characterized by near-zero interest rates and extensive quantitative easing, the central bank has taken a bold step in responding to the evolving economic landscape. In a move to address rising inflation, the Federal Reserve performed the fastest rate hike in US history, and the federal funds rate now stands at its highest level in decades.

The timing and magnitude of these rate hikes have raised questions about their potential impact on an economy that has grown accustomed to low borrowing costs. Low interest rates, like the ones experienced this past decade encourage economic expansion by encouraging borrowing and investment in the economy. As interest rates rise, the potential consequences of such actions on consumer behaviour, business investments, and financial markets cannot be overlooked. While higher interest rates may be a prudent response to prevent further inflation, they can also amplify existing vulnerabilities, especially in sectors heavily reliant on low borrowing costs.

As the dust settles from these rapid interest rate hikes, the effects on the economy remain uncertain. For businesses and consumers, the higher cost of borrowing could lead to reduced spending and investments. It may also impact industries that rely heavily on credit, such as housing and automotive sectors. Moreover, the tightening of credit conditions could affect access to financing for small businesses, potentially hindering their growth and expansion plans. Together, these factors could slow down the economy and make the possibility of a recession all the more likely.

3. Largest Bank Failures since The Great Financial Crisis

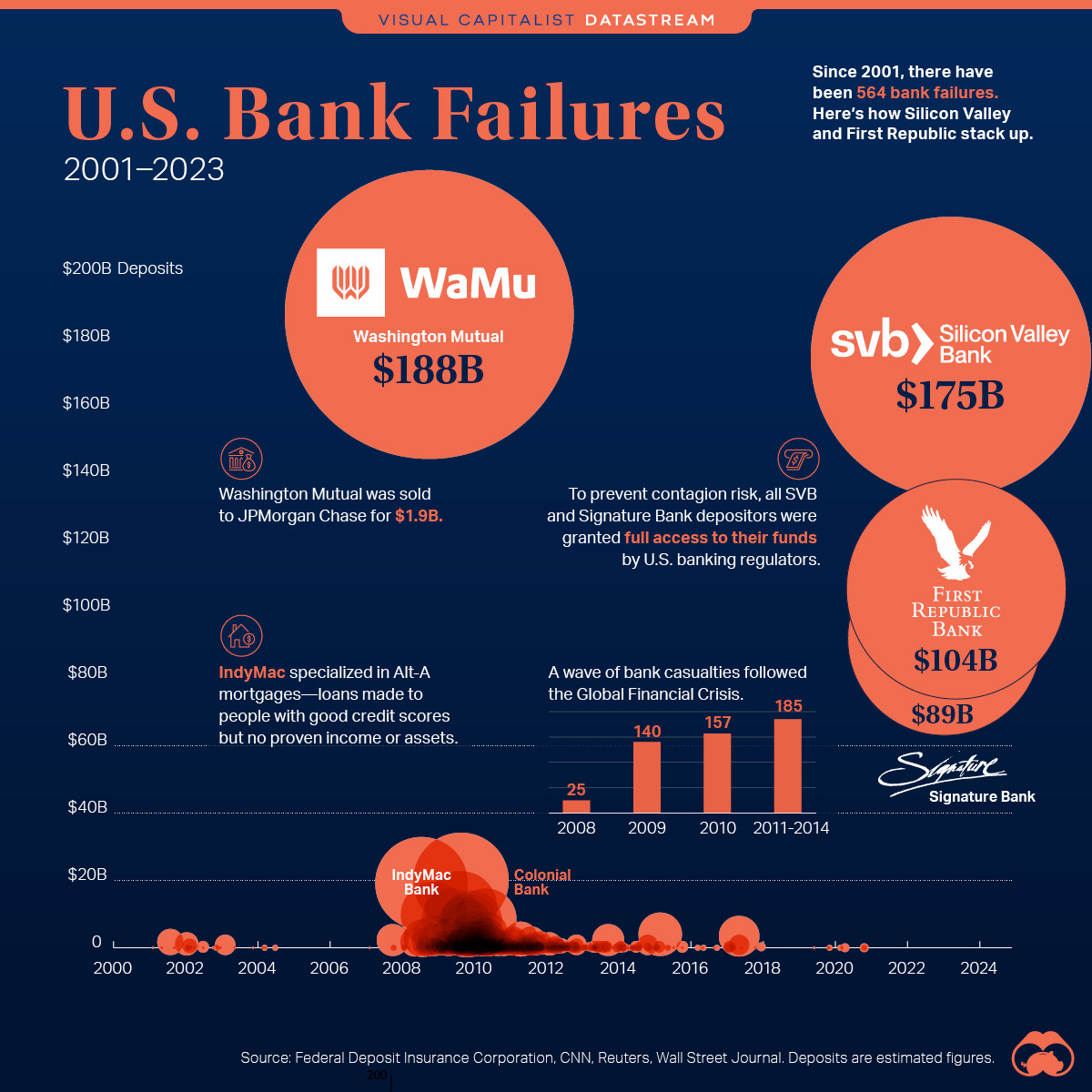

One significant consequence of the fastest rate hike in US history was the failure of several large banks in March 2023. Among them, Silicon Valley Bank (SVB), Signature Bank, and First Republic Bank experienced distress, marking the largest bank failures since 2008 and the second largest bank failure in US history.

The banks that failed largely experienced what is known as duration risk. During the height of the COVID-19 pandemic, banks received a massive influx of deposits thanks to individuals who had just received stimulus cheques. Not knowing what better to do with the cash, banks like SVB used the new money to purchase long-duration government bonds under the forward guidance of the Federal Reserve who ensured they were not even considering raising interest rates any time soon.

Banks like SVB purchased bonds when their price was high, and their yield was low. What followed was the fastest interest rate hike in US history. This increase in interest rates affects both the yield and price of bonds. As interest rates rose rapidly, banks like SVB found themselves subject to duration and liquidity risks. The price of the bonds they had purchased fell dramatically and the yields rose in response to the rise in interest rates. These banks found themselves with massive paper losses—a serious concern for their liquidity. If depositors demanded their money back, the banks would be forced to liquidate their bond holdings at a substantial loss, potentially leading to collapse.

Unfortunately for them, a bank run is what occurred. In the spring of 2023, depositors rushed to get their money out of these financial institutions. Banks like SVB were forced to lock in these paper losses on their bonds, leading to a solvency crisis since they did not have the cash to fulfill their deposit outflows. This led to the collapse of these banks.

This situation echoes the beginnings of many recessions and could provide us insight as to why the economy may be slowing. Six months before The Great Financial Crisis in the fall of 2008, Bear Sterns, a major investment bank in the US failed. With the failure of SVB, Signature Bank, and First Republic in March of 2023, could there be more turmoil ahead? If history repeats, we could see a recession as early as the fall of 2023, marking six months since the major bank failures earlier this year.

4. Unemployment Rate Bottoming?

One defining characteristic of a recession is the rise in unemployment as the economy slows down, leading to job losses. However, it's important to note that unemployment is a lagging indicator, meaning it tends to increase after the recession has already begun, not before. This raises the question—what does unemployment look like before a recession?

Interestingly, unemployment often exhibits a distinct pattern before a recession, typically reaching a low point before the economic downturn commences. We can observe this trend unfolding, with the current unemployment rate standing at a mere 3.6%, a remarkably low figure compared to the peak of the pandemic when unemployment surged to 14.7%.

A historical analysis of prior recessions also reveals a similar trend, wherein unemployment hits a local bottom just before the recession starts, and subsequently, unemployment rises as the economic downturn takes hold. Therefore, closely monitoring unemployment trends can provide essential indicators of the economy's health and serve as an early warning signal for an impending recession.

5. Declining Purchasing Manager’s Index (PMI)

The Purchasing Managers' Index (PMI) is a critical economic indicator that provides valuable insights into the health of the manufacturing and services sectors. As a leading indicator, changes in the PMI can foreshadow shifts in the overall economic activity, making it an essential tool for identifying potential economic downturns, including recessions.

During periods of economic expansion, the PMI typically registers above the threshold of 50, indicating growth in manufacturing and service activities. However, as an economy approaches a potential recession, the PMI tends to decline, reflecting a contraction in these sectors.

A declining PMI signals a slowdown in production, new orders, employment, and other key components, indicating reduced business activity. Businesses may experience declining demand for their products or services, leading to production cutbacks and workforce adjustments. When the PMI starts to decline and consistently remains below 50, it suggests that the economy may be entering a downturn. As businesses become more cautious in their operations, they may reduce their investments and hiring, exacerbating the economic slowdown and contributing to the onset of a recession.

Currently, the PMI has been in steady decline since it first fell below 50 in November of 2022 hinting towards a possible economic downturn.

6. Tightening Credit Conditions

Another indicator pointing to a potential recession is the tightening of credit conditions in the economy. Credit conditions refer to the availability and cost of borrowing money for businesses and individuals. During periods of economic expansion, credit conditions tend to be more relaxed, with lenders being more willing to extend credit at lower interest rates. However, as the economy faces potential headwinds, credit conditions may start to tighten.

One major driver of tightening credit conditions is the Federal Reserve's monetary policy stance. With the Federal Reserve now engaging in aggressive interest rate hikes and quantitative tightening, it’s no doubt credit conditions have tightened in the economy.

Recent data from FRED show domestic banks tightening lending standards aggressively to levels we have not seen since the Great Financial Crisis in 2008 and the COVID-19 pandemic. Heightened lending standards are represented by the blue line and it should be noted they tend to coincide with recessions as represented by the grey-shaded areas. Subsequently, new loans have taken a nose-dive as shown in orange, as banks are more wary of extending credit in the economy.

As credit becomes less accessible and borrowing costs rise, businesses and individuals may face challenges in securing funding for investments, expansion, or daily financial needs. This can lead to reduced consumer spending, business investments, and overall economic activity, potentially exacerbating the conditions for an economic downturn. While tightening credit conditions alone may not definitively predict a recession, their correlation with previous economic downturns demands attention and caution from investors and policymakers alike.

7. The Fed Predicts a “Mild Recession”

In April 2023, the Federal Reserve went on record stating that even they expect a 'mild recession' following their aggressive tightening in the economy. When the Federal Reserve predicts a recession, it indicates its conclusions based on its analysis of the economy and its many complex dynamics, including inflation, unemployment, GDP, and much more.

While they may only predict a ‘mild recession,’ this warning should not be taken lightly, as even a small recession can have significant impacts on the economy and its populace. Consider when inflation first began to rear its ugly head in 2021, the Fed claimed it was ‘transitory.’ What followed was the highest inflation levels in 40 years. In the same way, the Fed's prediction of a ‘mild recession’ should indeed be taken with a grain of salt as no one can predict the results of an organism as complex as the economy.

The Federal Reserve's acknowledgment of a potential recession aligns with other indicators pointing in the same direction, such as the declining PMI, yield curve inversions, and the failure of major banks. These converging signals collectively paint a compelling picture of a potential economic downturn on the horizon and should not be dismissed lightly.

Final Thoughts

The signs of a looming recession are becoming increasingly evident as we enter the final stretch of 2023. The seven indicators discussed in this article offer a comprehensive view of the current economic landscape, providing insights into the potential challenges and risks that lie ahead.

The yield curve inversion, with the 10-year and 2-year treasury bonds deeply inverted, points to investor uncertainty and concerns about the near-term economic outlook. Coupled with the Federal Reserve's aggressive rate hike, pushing the federal funds rate to its highest level in decades, the economy faces potential headwinds as businesses and consumers adjust to higher borrowing costs.

The failure of major banks, such as Silicon Valley Bank and Signature Bank, echoes historical precedents and highlights vulnerabilities in the financial sector. These failures can reverberate through the economy, affecting credit availability and investor confidence, which can further exacerbate economic challenges.

The tendency of unemployment to reach a low point before a recession commences raises questions about the current low unemployment rate. While it may seem positive on the surface, it could mask underlying weaknesses in the economy that may manifest as the recession unfolds.

The declining Purchasing Managers' Index (PMI) serves as an early warning sign, indicating a contraction in manufacturing and service activities. As businesses adjust their operations in response to weakening demand, this trend may further contribute to an economic slowdown.

Lastly, the Federal Reserve's prediction of a mild recession adds credibility to the overall assessment of potential economic challenges. As the central bank responsible for guiding monetary policy, their awareness of risks speaks heavily to the possibility of a slowing economy.

The combination of these indicators offers a clear view of potential economic challenges ahead. Although the precise timing and severity of a recession are uncertain, it is crucial to stay informed about the current economic environment. With awareness, wise decision-making, and a long-term perspective, we can navigate through periods of economic uncertainty with resilience.